Have you been waiting on the sidelines to enter the Ottawa real estate market? There are some encouraging signs that things are stabilizing!

Based on the most recent data from the Ottawa Real Estate Board, February saw lower asking prices, fewer new listings and a decrease in days on the market.

Let’s dive a bit more into the numbers:

- The average sale price for a freehold property in February was $708,968, a decrease of 15% from 2022. However, it marks a 5% increase over January 2023.

- The average sale price for a condominium-class property was $410,927, decreasing 12% from a year ago.

- With year-to-date average sale prices at $695,086 for freeholds and $411,449 for condos, these values represent a 14% decrease over 2022 for freehold-class properties and a 10% decrease for condominium-class properties.

What about inventory and new listings?

- February’s new listings (1,366) were 22% lower than February 2022 (1,762) and up 3% from January 2023 (1,323). The 5-year average for new listings in February is 1,632.

- Days on market (DOM) for freeholds decreased from 43 to 37 days and 47 to 43 days for condos compared to last month.

Ottawa Real Estate Board’s President Ken Dekker says this data could be an indicator that buyers have normalized to current interest rates.

“With the Bank of Canada holding interest rates steady, prospective buyers have more budget certainty to work with as we head into the spring market,” Dekker says. However, as he points out, if supply doesn’t increase, the recent balanced market could be heading to seller’s market territory.

According to Royal LePage, Canadians who have put their home purchase plans on hold during the recent unsteady times say they will resume their search this spring.

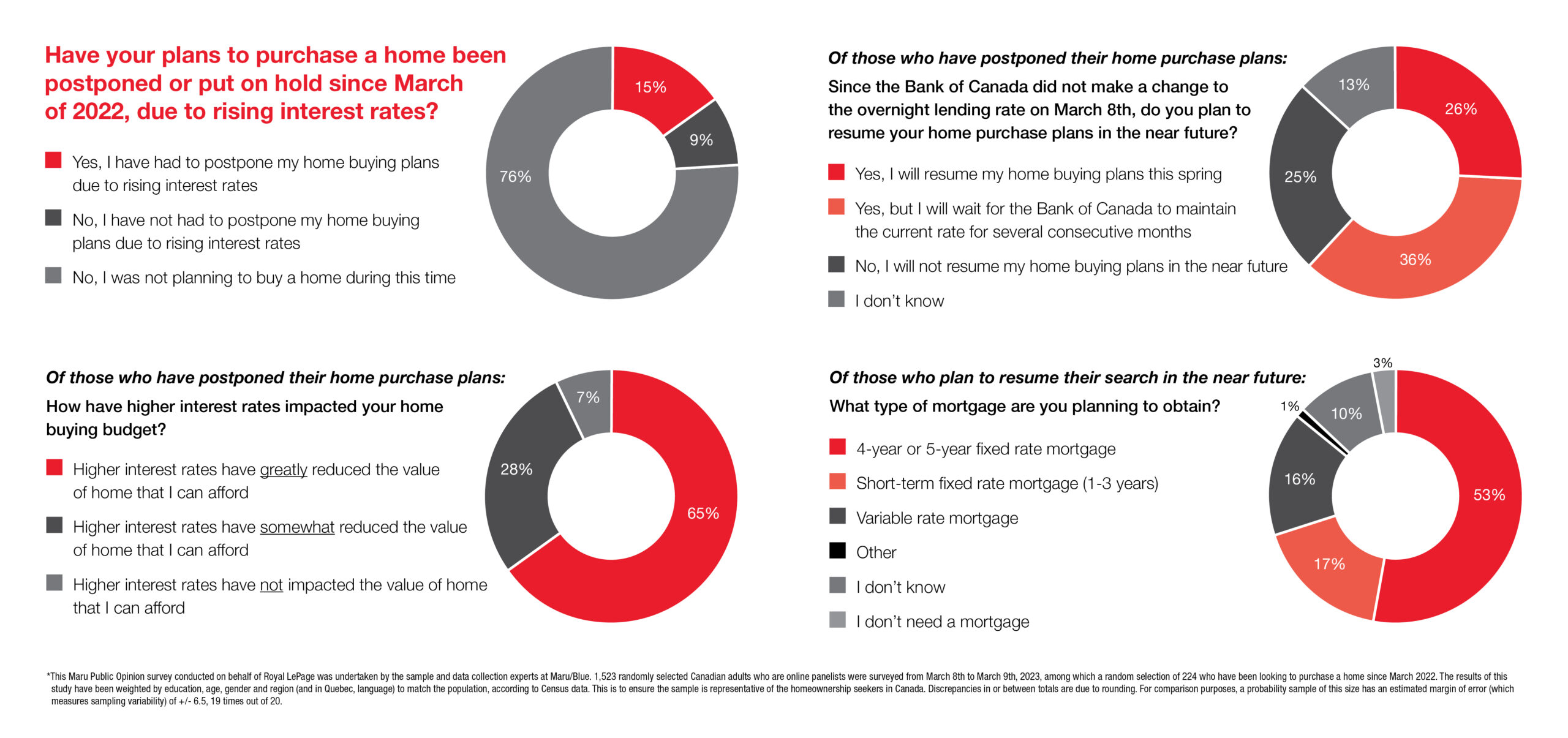

About 63% of Canadians postponed their homebuying plans due to rising interest rates. Of those who said they postponed their plans, 62% say they plan to test the waters and return to the market this year.

Of those polled, more than one third (36%) say they plan to move forward with their buying intentions, but will wait for the Bank of Canada to maintain the current 4.5% overnight lending rate for several consecutive months.

“Eight times a year, the Bank of Canada announces changes to its key interest rate, and for eight consecutive meetings, they aggressively raised rates in an effort to tame runaway inflation. On March 8th, 2023 they did nothing and doing nothing was a very big deal,” said Phil Soper, president and CEO of Royal LePage. “Based on our just-completed national survey, this was the signal that many Canadians were waiting for – an indication that it was safe to wade back into the housing market to search for the family home they so desperately want or need.”

The survey, conducted on behalf of Royal LePage by Maru, also found that 65% of Canadians who stated that their home buying plans were postponed report that higher interest rates have greatly reduced the value of home they can afford. Of those who chose to postpone their home purchase plans, 67% are between the ages of 18 and 34.

For those Canadians who intend to jump back into the housing market, many are gravitating towards a fixed rate mortgage. More than half (53%) say they would choose a four- or five-year fixed rate mortgage, and 17% say they would choose a short-term fixed-rate mortgage (1-3 years).

My team and I have been helping Ottawa residents for years in making sure their next move goes as smoothly as possible. From just-looking, to seasoned homeowner, we offer a refreshing, award-winning and client-centred approach.

Feel free to call us at 613-620-3870 or email me at sue@dunton.ca if you have any questions!